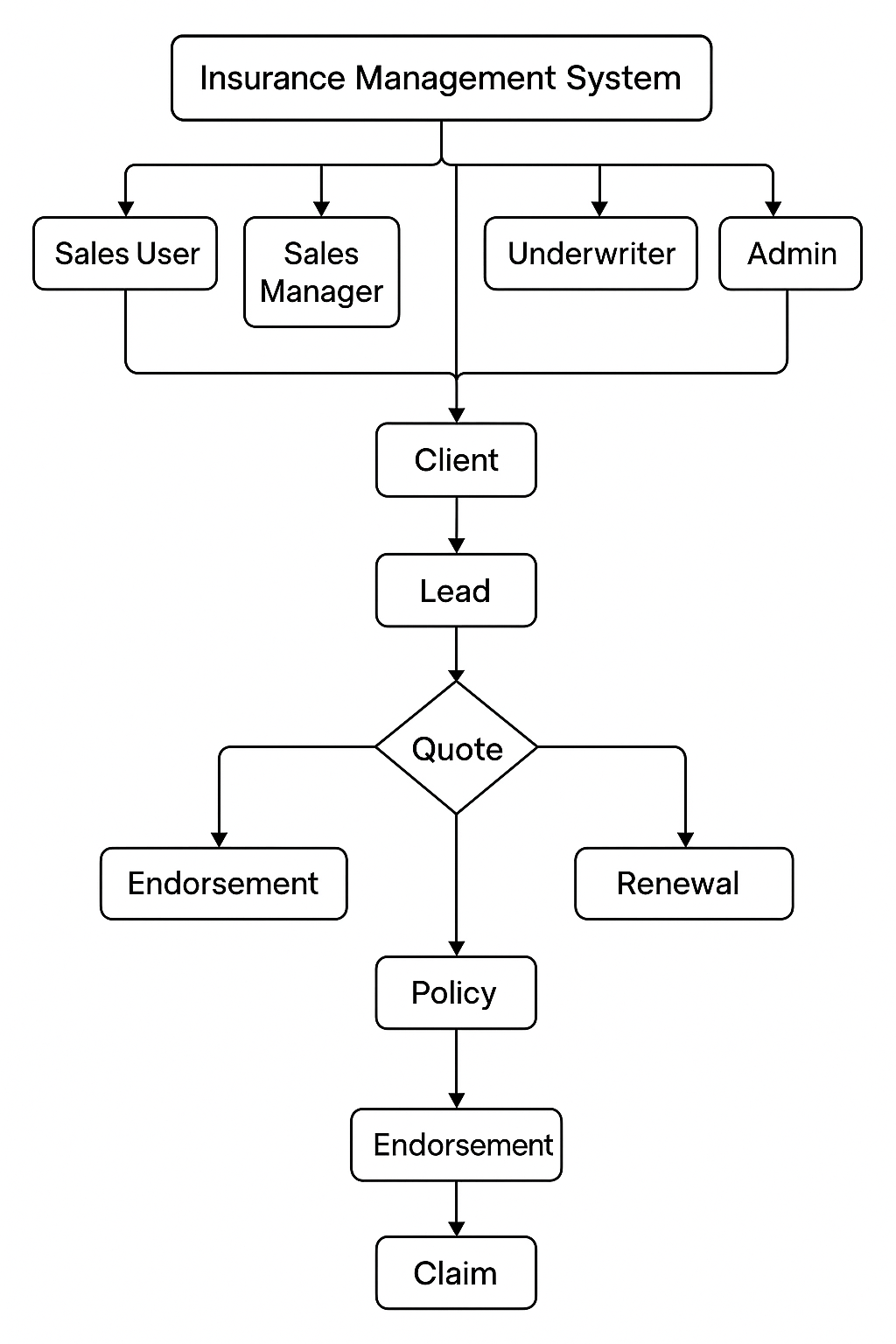

Insurance Management System

An effective insurance management system centralizes operations to boost efficiency and accuracy. By automating complex workflows, this platform significantly reduces overhead, eliminates manual errors, and provides the seamless scalability required for competitive business growth.

PoliSynQ

- Customer Onboarding

- Capturing A Lead

- Selling A Policy

- Managing Claims

- Endorsements

- Handling Renewals

Key Features of PoliSynQ

Client Management

- Stores complete customer profiles (personal, financial, policy history).

- Tracks interactions, preferences, and communication logs.

- Provides a unified dashboard for viewing all client-related information.

- Supports KYC verification and document management.

- Stores complete customer profiles (personal, financial, policy history).

- Tracks interactions, preferences, and communication logs.

- Provides a unified dashboard for viewing all client-related information.

- Supports KYC verification and document management.

Lead Management

- Captures leads from multiple sources (website, campaigns, referrals).

- Assesses lead quality and assigns leads to agents automatically.

- Tracks lead progress through stages: New → RFQ → Quote processing → Closed Won.

- Captures leads from multiple sources (website, campaigns, referrals).

- Assesses lead quality and assigns leads to agents automatically.

- Tracks lead progress through stages: New → RFQ → Quote processing → Closed Won.

Quote Management

- Generates instant insurance quotes based on Leads data.

- Compares premiums, coverage, riders, and insurer offerings.

- Allows customizing quote options according to client needs.

- Stores quote history for future reference and follow-up.

- Generates instant insurance quotes based on Leads data.

- Compares premiums, coverage, riders, and insurer offerings.

- Allows customizing quote options according to client needs.

- Stores quote history for future reference and follow-up.

Policy Management

- Generates instant insurance quotes based on Leads data.

- Stores policy documents, terms, premium schedules, and beneficiaries.

- Supports multiple insurance types (Fire, motor, health, life, travel, etc.).

- Alerts users and agents about upcoming due dates and changes.

- Generates instant insurance quotes based on Leads data.

- Stores policy documents, terms, premium schedules, and beneficiaries.

- Supports multiple insurance types (Fire, motor, health, life, travel, etc.).

- Alerts users and agents about upcoming due dates and changes.

Claims Management

- Allows customers to report claims digitally with the necessary documents.

- Automates claim verification, approval workflow, and status tracking.

- Facilitates communication between insurers, clients, and claim teams.

- Provides analytics to monitor claim ratios and identify fraud risks.

- Allows customers to report claims digitally with the necessary documents.

- Automates claim verification, approval workflow, and status tracking.

- Facilitates communication between insurers, clients, and claim teams.

- Provides analytics to monitor claim ratios and identify fraud risks.

Endorsement Management

- Supports policy modifications such as address change, nominee update, vehicle change, etc.

- Tracks endorsement requests and approvals.

- Automatically updates policy documents after endorsement.

- Keeps audit trails for compliance and record-keeping.

- Supports policy modifications such as address change, nominee update, vehicle change, etc.

- Tracks endorsement requests and approvals.

- Automatically updates policy documents after endorsement.

- Keeps audit trails for compliance and record-keeping.

Renewal Management

- Sends automated reminders before policy expiry.

- Allows quick online renewal with updated premium calculations.

- Supports cross-selling and upselling during renewal (add-ons, riders).

- Provides a smooth, one-click renewal experience for customers.

- Sends automated reminders before policy expiry.

- Allows quick online renewal with updated premium calculations.

- Supports cross-selling and upselling during renewal (add-ons, riders).

- Provides a smooth, one-click renewal experience for customers.

Controlled Access to Modules

- Each user role: Sales, Underwriter, Claim Manager, Admin, while the Client gets access only to relevant modules, such as:

- Sales → Leads, Quotes, Customers, Policy

- Underwriter → Quote Creation

- Claim Manager → Claim Assessment, Investigation

- Client → Policy View, Renewals, Claims

- Admin → Full system access

This ensures security, clarity, and efficient workflows.

- Each user role: Sales, Underwriter, Claim Manager, Admin, while the Client gets access only to relevant modules, such as:

- Sales → Leads, Quotes, Customers, Policy

- Underwriter → Quote Creation

- Claim Manager → Claim Assessment, Investigation

- Client → Policy View, Renewals, Claims

- Admin → Full system access

Role-Based Dashboards

- A role-based dashboard structure ensures that every type of user gets the exact information and tools they need.

It improves efficiency, decision-making, customer service, and operational control.

- A role-based dashboard structure ensures that every type of user gets the exact information and tools they need.

Benefits of Custom PoliSynQ

Automate policy tracking & simplify lead-to-policy generation through efficient, integrated digital workflows

Speeds up claims processing with streamlined workflows

Enhances customer experience through faster, personalized service

Provides real-time insights with dashboards and reports

Strengthens compliance with built-in regulatory controls

Operational efficiency by reducing manual tasks like data entry, allowing staff to focus on client relationships

A flow chart of how the product works